Look around your dealership. What are your customers doing? Presumably, the majority of them are glued to their phones – checking social media, browsing the internet, or reading the news. Some may even be sending out a quick text or ending a call while still in the service drive.

As a matter of fact, 53% of the customers at your dealership are comparing prices for vehicles at other dealerships, and 40% are finding prices for your vehicles on their smartphones1. Not to mention, 25% of all automotive searches are parts, service, and maintenance related2. What does this mean? It means dealers need a strong mobile and digital strategy to show up for parts, service, and new car searches.

Mobile technology goes hand-in-hand with digital to navigate the entire purchase journey

Today’s automotive customer journey is multi-screen, multi-device, and always connected. The average consumer has 3.2 internet connected devices3 and American adults dedicate over 11 hours per day to screen time4 - that’s nearly half a day!

Smartphones allow consumers immediate access to nearly all digital channels while on-the-go. Through a smartphone, consumers see: display ads, paid search ads, they are retargeted, they consume videos, surf social media, connect to their smart TVs, and so much more.

Need to re-evaluate your mobile-first digital strategy? Download our free checklist to get you started: [checklist download]

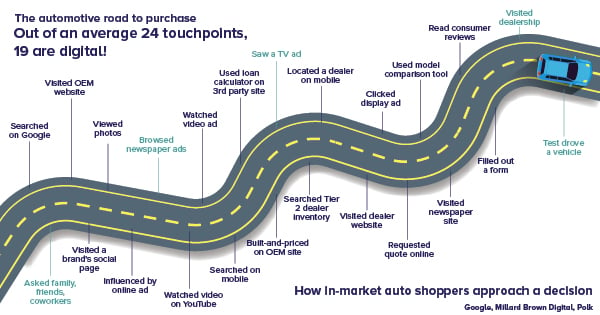

Why is this important? For the average, in-market auto shopper on the path to purchase, 19 out of 24 touchpoints are digital, meaning nearly 80% of the auto buyers’ journey is taking place on smartphones, computers, or tablets5.

The fine print: what mobile and digital do for your dealership

Digital brings dealers more money for a fraction of the cost of traditional media:

- Traditional media spots (TV, radio, billboards) bring in an average total profit of $1,702 per vehicle, whereas digital brings in a whopping $2,514 per sale6

- It only costs $150 of digital marketing to sell one car, compared to $1,581 in traditional media7

- Dealers pay 10X more than necessary using traditional advertising alone8

Mobile can accelerate time to purchase by 20%, which accelerates revenue and reduces costs9

- Mobile is the second highest driver of purchase consideration for auto shoppers10

- As consumers get closer to purchasing a new car, their ad recall (memory of an advertisement) for mobile increases by a whopping +217% and for digital it increases by 99%11

Many vehicle shoppers researching online make first contact by calling

- In 2016 alone, US search ads generated 40 billion calls, social ads produced 12 billion calls, and display ads caused 28 billion calls12

- 57% of consumers call about vehicles from a search ad call extension to schedule an appointment. Similar percentages of consumers call about inventory, pricing, and/or business hours13

- 66% of the automotive calls generated by search engines come from paid search. The other 34% are driven by organic search14

Today’s auto consumers want a speedy, relevant, and user-friendly shopping experience especially on mobile. Dealers who prioritize a mobile-first digital strategy will experience higher conversion rates, happier customers, less wasted ad-spend, and more data on their customers’ journey.

If you consider the volume of customer data available from mobile and other digital channels, it can be used to engage customers at the start and shape their purchase journey when they develop intent.

1 2017: Cox Car Buyer Journey

2 Google, 2017: Critical Mix Fixed Ops Study

3 2017; Boston Consulting Group (BCG): Mobile Marketing and the New B2B Buyer

4 Nielsen, 2018: U.S. Adults now Spend Nearly half a day Interacting with Media

5 Google, Millard Brown Digital, Polk

6-8 Digital Dealer: Why Auto Dealers Must Embrace Digital Marketing

9 BCG, 2017: Mobile Marketing and the new B2B Buyer

10-11 2018: Nielsen Auto Marketing Report

12 Search Engine Journal, 2017

13-14 DialogTech, 2019: 18 Statistics Automotive Marketers Need to Know in 2019